Wise.com Review – Unleashing Financial Freedom Through Seamless Cross-Border Transactions send receive and spend worldwide

Introduction: send receive and spend worldwide

Wise, formerly known as TransferWise, is a UK-based financial technology company founded by Estonian visionaries Kristo Käärmann and Taavet Hinrikus. Renowned for its expertise in cross-border payment transfers, Wise has become synonymous with seamless global financial transactions, offering users the ability to send, receive, and spend worldwide.

Empowering Financial Freedom:

Wise is not just a platform; it’s a financial ally that empowers users with the freedom to achieve their financial goals globally. The company’s commitment to “money without borders” is truly reflected in its range of services, allowing users to experience unparalleled Financial Freedom.

Diverse Product Offerings:

Wise offers three main products—Wise Account, Wise Business, and Wise Platform. Each serves a distinct purpose, catering to individuals and businesses alike. The Wise Platform API, in particular, empowers businesses to integrate smarter and more reliable payment experiences into their operations, enhancing the efficiency of paying international bills.

International Financial Accessibility:

With Wise, users gain access to an international account that transcends geographical boundaries. This not only facilitates seamless currency conversion but also empowers individuals and businesses to engage in global commerce with ease. Wise stands as a beacon for those seeking financial accessibility in the modern, interconnected world.

Transparent Pricing Considerations:

While Wise prides itself on transparency, users should be aware of the associated fees, especially when paying international bills. It’s crucial to evaluate these costs against the convenience and efficiency offered by Wise. Clear communication regarding fees and potential fluctuations would enhance user confidence and satisfaction.

External Factors:

Wise operates in a dynamic financial landscape influenced by currency fluctuations. Users may want to stay informed about market changes that could impact their experience when receiving money from abroad. Educational resources or alerts regarding these factors would further empower users in their global financial endeavors.

User Experiences:

Efficiency in Action:

Users consistently praise Wise for its swift and efficient services, emphasizing the platform’s ability to facilitate currency conversion seamlessly. The intuitive design of Wise’s interface ensures that individuals and businesses can navigate the platform with ease, making the process of sending, receiving, and spending worldwide a hassle-free experience.

Global Accessibility:

The concept of “money without borders” isn’t just a tagline; it’s the embodiment of Wise’s commitment to providing an international account that empowers users to engage in global financial activities. Whether it’s managing personal funds or conducting business transactions, Wise transcends geographical constraints, offering unparalleled accessibility.

Innovation with Wise Platform API:

Empowering Businesses:

One of the standout features of Wise is the Wise Platform API, which allows businesses to integrate customized solutions for their unique needs. This not only enhances the efficiency of international bill payments but also contributes to creating smarter and more reliable payment ecosystems within various industries.

Future-Forward Solutions:

Wise’s commitment to innovation is evident through its constant efforts to provide a platform that adapts to the evolving needs of users. The Wise Platform API, with its versatility and adaptability, positions Wise as a forward-thinking player in the financial technology sector.

Areas for Improvement:

Fee Transparency:

While Wise is known for its transparent fee structure, some users express a desire for even greater clarity, particularly when paying international bills. Clear communication regarding fees and potential fluctuations would enhance user confidence and satisfaction.

Educational Resources:

In the realm of global finance, understanding currency fluctuations is crucial. Wise could further empower users by providing educational resources or alerts regarding potential external factors that may impact receiving money from abroad.

Final Verdict:

Wise.com, the evolution of TransferWise, stands tall as a pioneering force in the financial technology landscape. With a focus on enabling users to seamlessly send, receive, and spend worldwide, Wise has become synonymous with international financial freedom. While considerations regarding fees and external factors are relevant, Wise’s commitment to innovation, accessibility, and efficiency solidifies its status as a reliable and groundbreaking platform in the world of cross-border financial transactions.

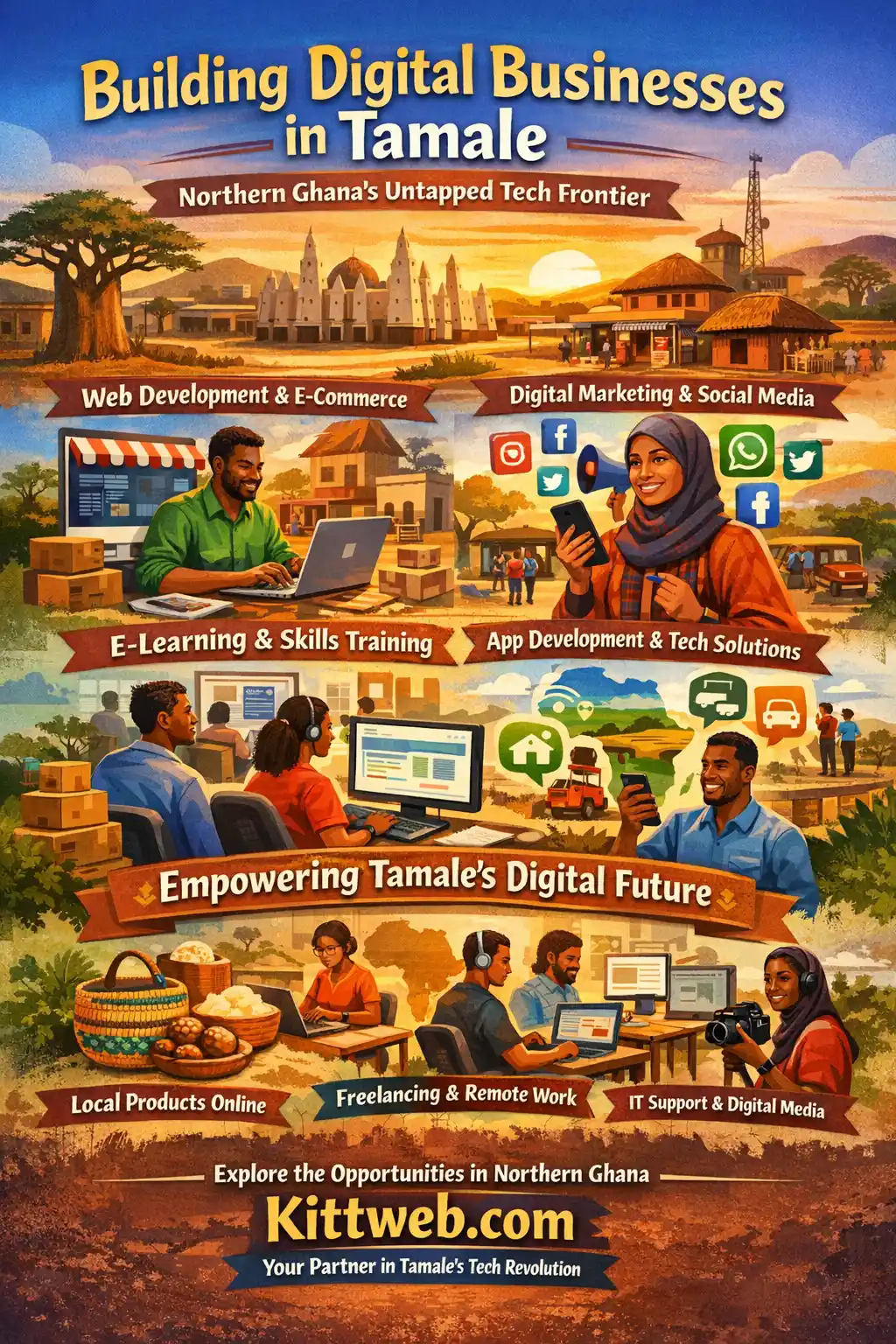

- Building Digital Businesses in Tamale: Northern Ghana’s Untapped Tech Frontier

- The Evolution of Web Development: Trends to Watch.

- Affiliate Publishers: Transform Your Traffic into Sustainable Revenue

- AI Site Builders vs. Traditional Site Builders: Who’s Going to Win the Race in 2026?

- WordPress vs Other site Builders

- About

- About us

- Adsterra Publisher vs Adsterra Affiliate: A Comparison

- affiliate

- Affiliate Disclosure

- Blog

- Cart

- Checkout

- Codecanyon

- Contact

- Cookies Policy

- Copyright & DMCA Policy

- Disclaimer

- Disclaimer

- Do-Not-Sell

- Elementor

- Elementor #Hosting-AI-Page-Builder

- Elementor Page Builder Pricing

- Hostinger

- How to Start a Blog Without Knowing How to Code: A Free Step-by-Step Guide with Web.com

- My account

- Pin Posts

- Portfolio Go

- Post

- Privacy Policy

- Promo Codes in Real-Time

- Safe Internet Privacy: 7 Tips for Protecting Yourself Online

- Services

- Shop

- Shop

- Terms and Conditions

- Unveiling Fiverr: Your Go-To Freelance Services Marketplace to Find Top Global Talent

How to Write a Blog Post That Encourages Readers to Take Action for free

0 Comments